2025 Form 1099 Filing Requirements

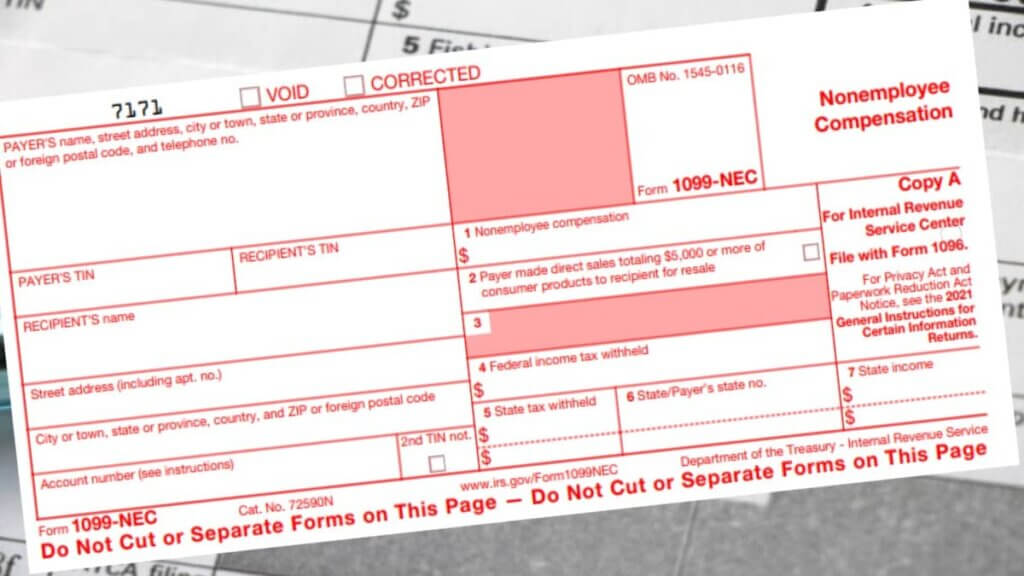

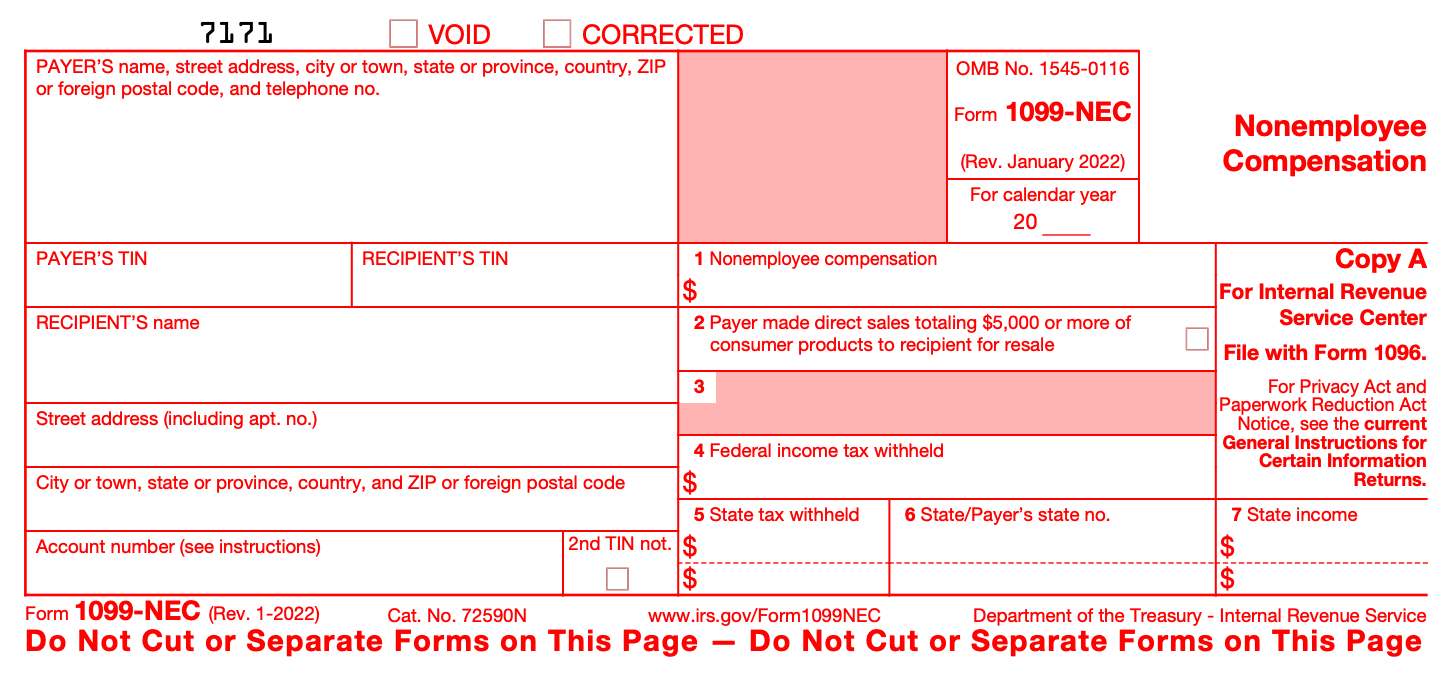

2025 Form 1099 Filing Requirements. For internal revenue service center. Taxpayers must report any income received from the 1099 forms on.

To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec.

Form 1099NEC Instructions 2025 2025, Generally, an organization filing 10 or more returns or statements. Effective in 2025, businesses can file no more than 10 paper forms with the irs.

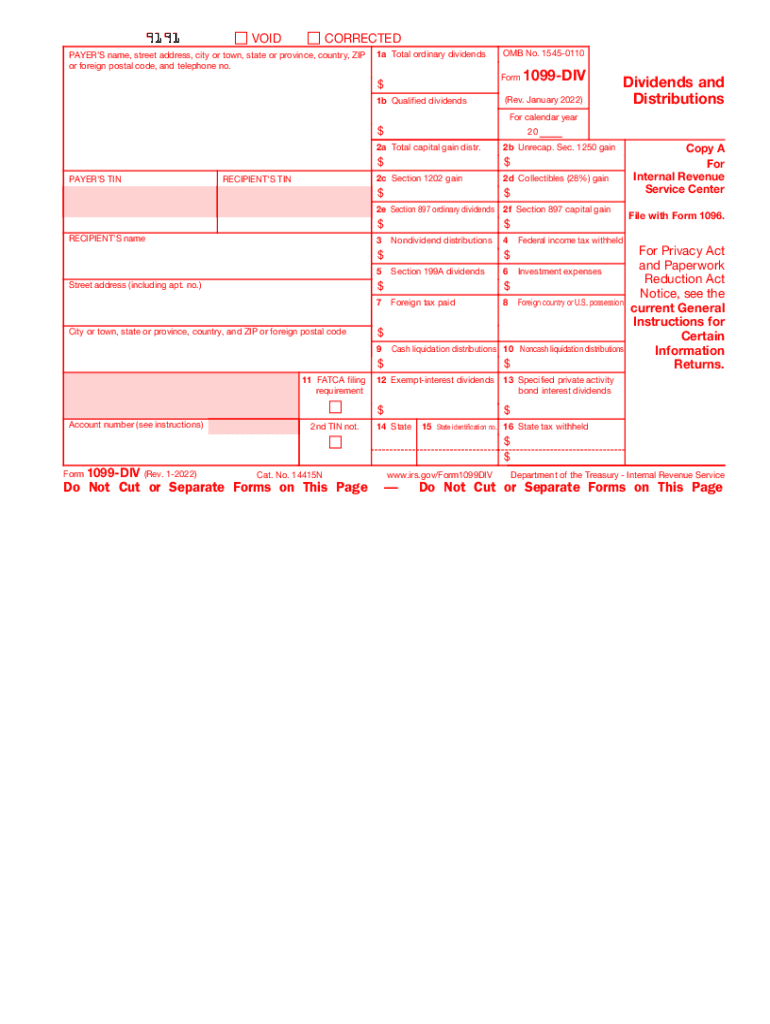

1099G Form 2025 2025, In response to input from. With the new aggregation rule, businesses add the number of.

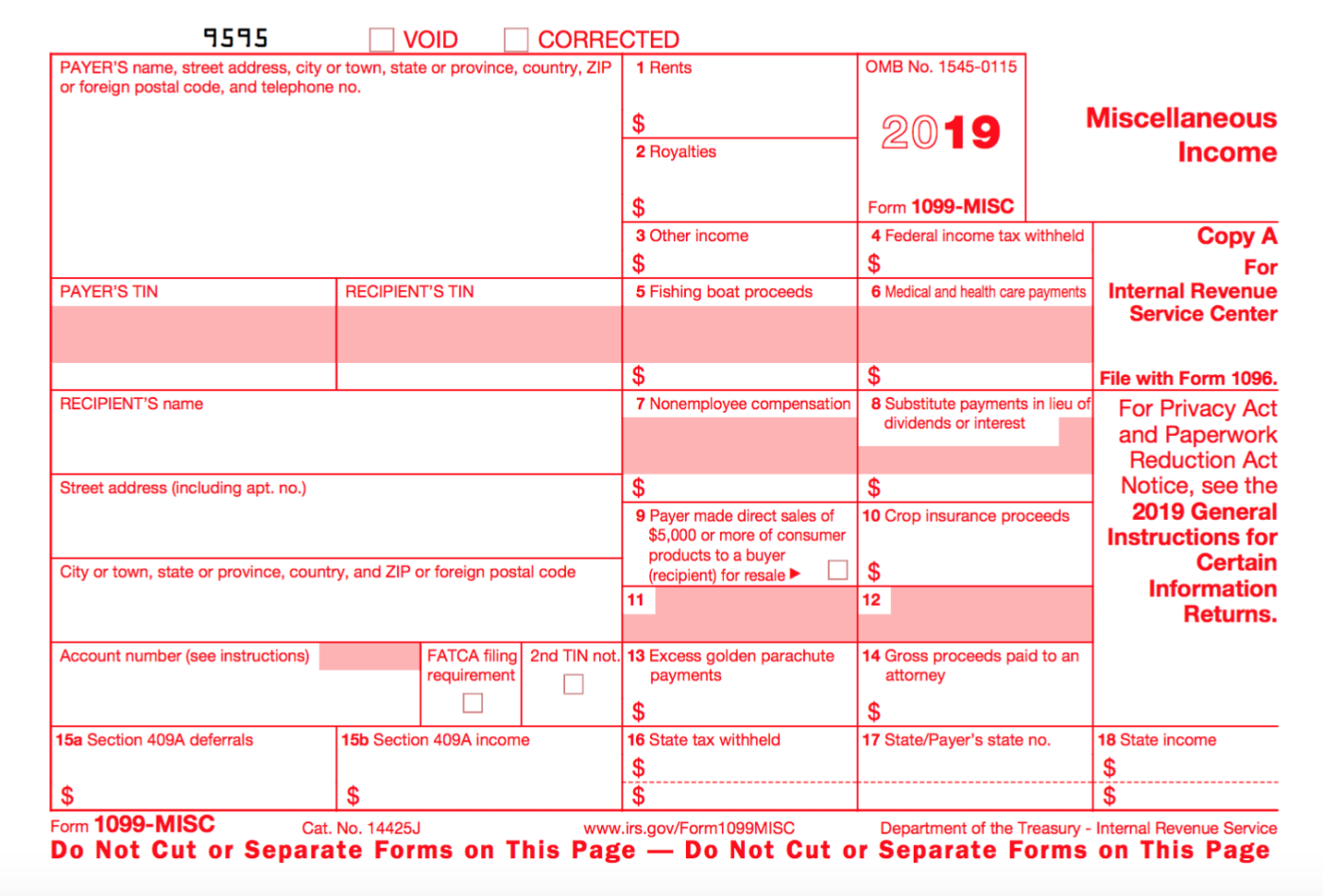

Tax Form 1099MISC Instructions How to Fill It Out Tipalti, Small business owners or employers need to prepare and file the applicable 1099s to the irs before the 1099 deadlines otherwise. Discover why thousands of employers trust boomtax for 1099.

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting, However, if that date falls on a weekend,. Discover why thousands of employers trust boomtax for 1099.

20222024 Form IRS 1099DIV Fill Online, Printable, Fillable, Blank, Generally, an organization filing 10 or more returns or statements. Businesses must supply 1099 to contractors and vendors and file a copy with the irs by jan.

What is a 1099? Types, details, and who receives one QuickBooks, For internal revenue service center. There are five filing statuses:

All That You Need To Know About Filing Form 1099MISC Inman, Interested candidates must apply online. Irs dramatically expands electronic filing mandate in 2025.

What Is Form 1099MISC? Do I Need to File a 1099MISC? Gusto, As per the notification, the application window will remain open from march 19, 2025 (12:00 pm) to april 17, 2025 (11:59 pm). The irs filing season 2025 deadlines for tax year 2025 are as follows:

1099 Filing Requirements, For internal revenue service center. Discover why thousands of employers trust boomtax for 1099.

1099 Form 2025 Editable Printable Calendar 2025 2025 CALENDAR PRINTABLE, This doesn’t mean 10 of. Businesses must supply 1099 to contractors and vendors and file a copy with the irs by jan.