Personal Car Mileage Rate 2025

Personal Car Mileage Rate 2025. As you calculate your company car allowance or mileage rate for 2025, keep in mind the following three pressure points for employees who drive personal vehicles. What’s the difference between mileage allowance and advisory fuel rates?

1, 2025, the standard mileage rate for the business use of a car (including vans, pickups, and panel trucks) is 67 cents per mile. Get emails about this page.

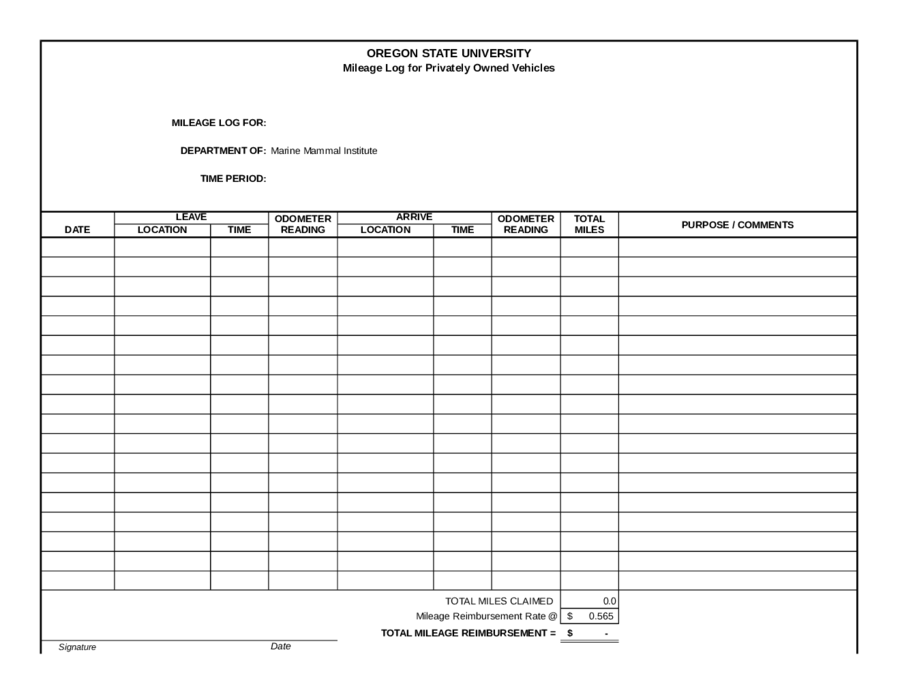

2025 Mileage Log Fillable, Printable PDF & Forms Handypdf, The 2025 irs mileage rates. With a remarkable mileage of 50 km/l and a price tag of.

2025 Mileage Log Fillable, Printable PDF & Forms Handypdf, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025 | internal revenue. Are travel reimbursements in india taxable?

Free Mileage Log Templates Smartsheet (2025), Irs announces standard mileage rates for 2025. 70¢ per kilometre for the first 5,000 kilometres driven;

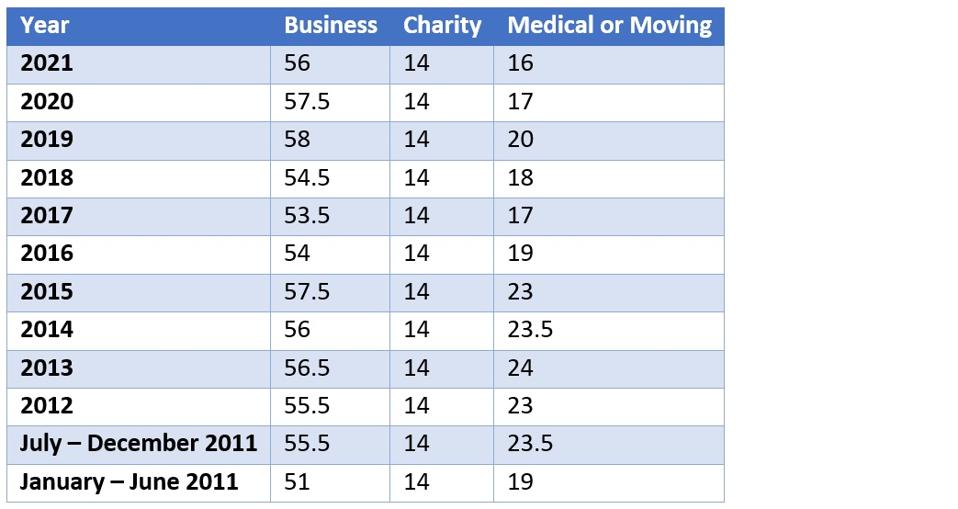

Table showing historical IRS mileage rates, This rate reflects the average car operating cost, including gas, maintenance, and depreciation. Standard mileage rates for 2025.

2025 standard mileage rates released by IRS, 45p for the first 10,000 business miles. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2025.

Standard Mileage vs. Actual Expenses Getting the Biggest Tax Deduction, Story by kelly phillips erb, forbes staff • 2mo. Standard mileage rates for 2025.

IRS Mileage Rate for 2025 What Can Businesses Expect For The, For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Car mileage, which covers cars and vans:

New Mileage Rate Method Announced Generate Accounting, The irs mileage rate in 2025 is 67 cents per mile for business use. What’s the difference between mileage allowance and advisory fuel rates?

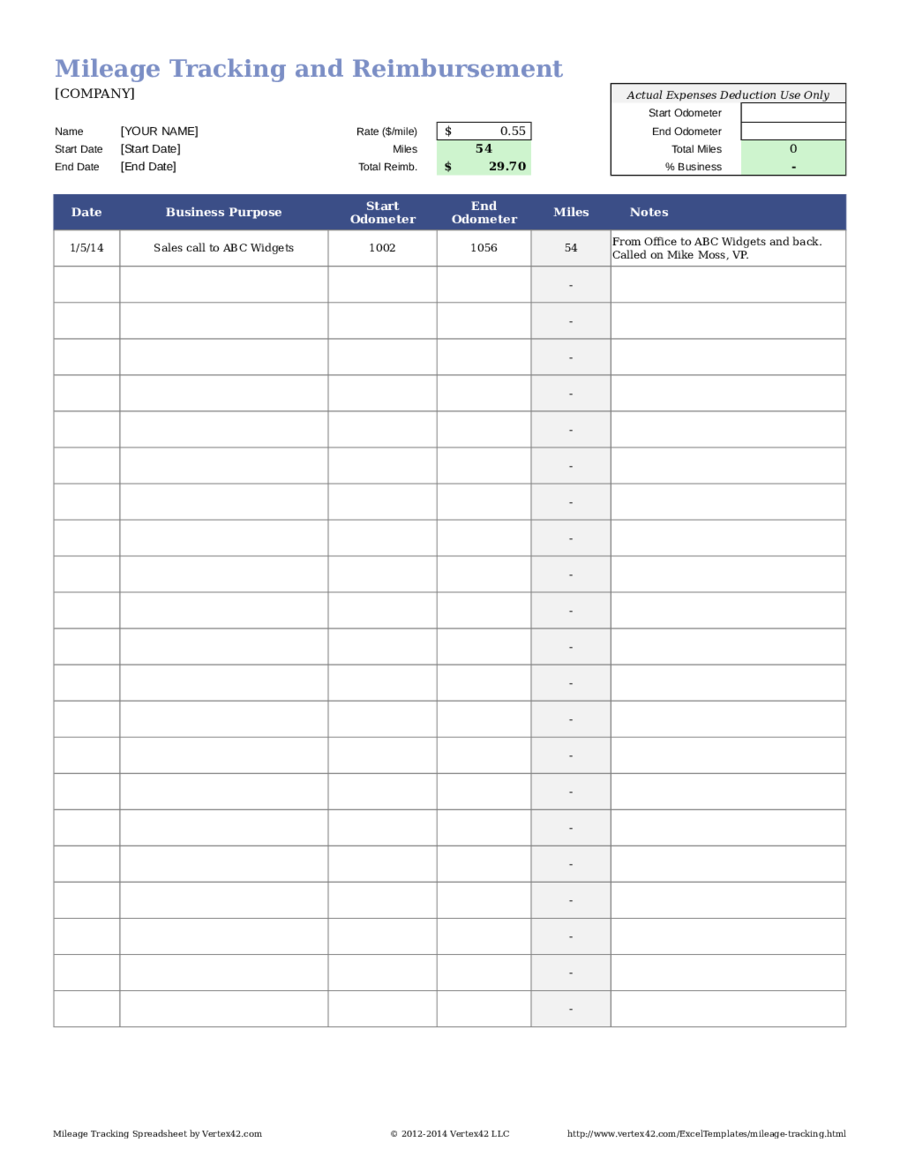

Personal Car Mileage Reimbursement Tracker Template Smartsheet, Story by kelly phillips erb, forbes staff • 2mo. Why are advisory fuel rates not.

IRS Announces 2025 Mileage Reimbursement Rate, 70¢ per kilometre for the first 5,000 kilometres driven; For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.